Early Years

Do you remember the multiplication flashcard battles in elementary school? I always loved those. They combined two things that I’ve always enjoyed; competition and numbers. If you asked anyone who knew me growing up, they would’ve probably told you that I would grow up to do something sports-related or with numbers. They would’ve been right.

Going into my Junior year at Georgia Tech, I knew I had the potential to be drafted pretty high. My agent and now friend, Myles, recommended that I meet someone who could help me figure out what to do with the money I would eventually make in the draft.

I took the meeting not knowing what to expect and left not understanding much of what we’d just talked about. The guy I met with was a former player, easy to talk to, and just a likable guy. Based on those criteria, along with my trust in Myles, I had a financial advisor shortly after that meeting. More importantly, I had developed an intrigue into a world I didn’t know much about.

I grew up in a loving home without a want in the world. My parents worked hard and made sure we had everything we needed. It wasn’t until I got older that I realized what our financial situation was. We weren’t poor by any stretch of the imagination, but we weren’t wealthy either. We were your average middle-class family living paycheck to paycheck at times.

While we didn’t talk about investing, I did learn a lot from my parents, especially my mom. She taught me how to balance a checkbook, build my credit, and avoid debt. These basic financial skills are not something most people get growing up. They don’t teach it in school and if your parents don’t teach you, you will most likely have to learn it the hard way. I’m thankful my parents did

Draft Day

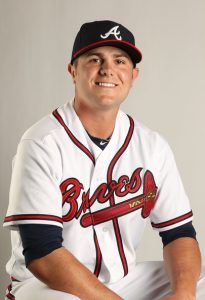

Draft day came and I was blessed to be taken in the 4th round by the Atlanta Braves. My signing bonus was more money than I had ever seen in my life. I was thankful to have met my advisor, but also didn’t know him well enough to put complete trust in him yet. This led to me taking a greater interest in where my money was being invested.

Draft day came and I was blessed to be taken in the 4th round by the Atlanta Braves. My signing bonus was more money than I had ever seen in my life. I was thankful to have met my advisor, but also didn’t know him well enough to put complete trust in him yet. This led to me taking a greater interest in where my money was being invested.

I feel like I should mention that I was drafted in 2006. Having split my bonus to be paid over two years, I didn’t receive the second part until January of 2007. In April of 2007 I tore the UCL (Tommy John ligament) in my elbow. I spent the next few months rehabbing only to ultimately have surgery in August.

Rookie Mistakes

During this rehab time, I began to look into my investments even more as well as starting to do “research” on potential opportunities. One of those opportunities was Apple. They were set to launch the first ever iPhone in June. I felt confident in this buy so I called my advisor to see what he thought. He agreed and we purchased some shares for my portfolio.

Between that recommendation and a few others, I was “getting pretty good” at this stock picking thing. Mind you, the market was pretty on fire in 2006 and early 2007. I don’t need to tell you what happened next.

I was so heavily invested in individual stocks that my portfolio was down almost 60% at the bottom. Throw that on top of rehabbing my elbow over that whole year and it was a very emotional time for me.

Trajectory Changed

I was finally over it by the end of 2008. I was ready to sell everything and go buy some land with what I had left. Thankfully my advisor talked me down and we did some tax loss harvesting. This one decision has completely changed the trajectory of my life.

First, it taught me a great lesson in having a long-term focus. It also changed what life looked like for me after baseball. Keeping the money invested and not touching it led to me leaving the game with more money than my pre tax signing bonus. This allowed me to go back to finish school without worrying about money as well as allowed me to be in a place to start my own firm 5 years after that.

I was able to play again after my surgery and had some great opportunities. I got to play in the Arizona Fall League against some of the best young players in the game in the Fall of 2009. This led to me being placed on the 40 man roster and getting an invite to Major League Camp with the Braves (something I got to do twice).

In 2011, my baseball trajectory changed. From that Spring on I got to play with the Nationals, Yankees, and Reds. All this to share that I was lucky enough to play for a long time and played with a lot of guys.

Roller Coaster Ride

My last year in professional baseball was 2014. I had just had the best year of my career and was headed into Major League Camp with the Reds. I had a great Spring Training and just missed making the team out of camp.

After getting off to a great start to the season I had a terrible outing in Norfolk, VA (my nemesis) followed by a lot of inconsistency. In June of 2014, the Reds released me. I played a month of independent ball in Summerset, NJ but knew my time playing was over.

The thought of never playing baseball again was heartbreaking. I knew the game I’d played for 25 years was over and I had failed to reach my goal of becoming a Major Leaguer. While I was filled with many different emotions, I was thankful to know what I wanted to do next.

Lessons Learned and New Beginnings

I learned a lot during my time in the game. What I saw was that most guys chose their advisor for the same reason I did. Their agent recommended them and they liked them personally. I also found out that most guys had no clue what their financial advisor was doing with their money or how much they were actually paying them.

One of the things that stood out the most was that many guys who didn’t make it (which is most) left the game with very few options and no degree. Even guys with 1st round signing bonuses. This led to them taking whatever job they could get or giving lessons for a living out of necessity. I will say that I know some who were passionate and built a business around it. But more often than not, guys did not have many choices.

The longer I played, I began to realize something was missing in the financial planning industry and I knew I wanted to try and fill that void. As my baseball career ended, I was eager to pursue that vision.

Comments are closed.