Timing the Market VS. Time in the Market

This month we wrap up our quarterly discussion by contrasting two very different approaches to investing; timing the market versus time in the market.

Crystal Ball Method

Timing the market is the act of placing bets on what you think the market will do. These bets are placed with the allocation of your money in your investment accounts.

If you think the market is going to do poorly, you will move to cash or “safer” investments. If you think the market is going to do well, you will be more aggressive with your investments. Often taking on more risk than your tolerance or capacity for risk would allow.

Timing the market can be blatant or subtle. In my opinion, based on what I’ve seen, the subtle form is the most common, though it’s often influenced by the blatant form.

Let’s discuss both below.

Blatant Timing

First, let’s acknowledge that there are people out there who blatantly claim they know what the market is going to do. Most of these people are prognosticators and/or pundits on TV or writing articles.

Almost all of the time these prognosticators are wrong, but because life moves fast and our attention spans have gotten small, we often don’t care to go back and point it out or it just doesn’t matter anymore because the next person has predicted something else that they are “100% locked” in on.

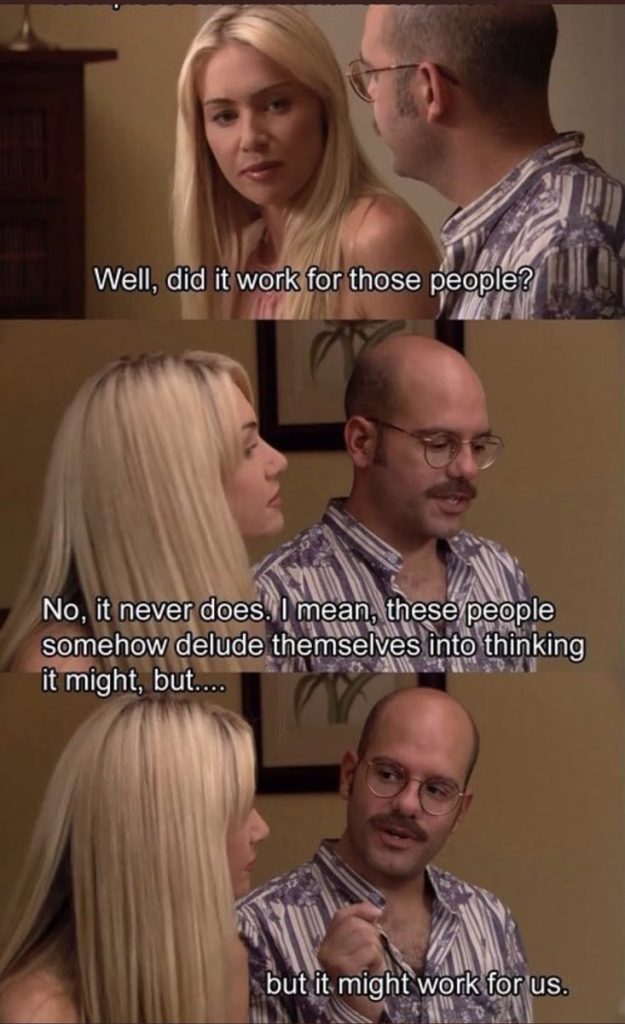

I will admit that oftentimes what they say is compelling. They seem so confident. They may have even been right in predicting a big event in the past. This makes what I’m going to say next even harder.

Whether you’re reading an article or watching something on tv or (even worse) on TikTok, please take a second to try and think about what their goal is. Is it really to give you, some random person, good advice? Or could it be to get clicks, views, or subscribers to create revenue for themselves?

This is pure speculation on my part, but I’d guess that less than half, maybe less than 25% of the people screaming market prognostications from the rooftops take their own advice. At least not with any significant amount of their net worth.

The blatant concept of timing the market is dangerous in my opinion because the advice given influences the subtle form of timing.

Subtle Market Timing

This happens on the consumer side. This is you and me. This form of timing actually leads to changes in how people invest their money.

The reasons given for making changes vary from political to “my friend said.”

Below are some paraphrased reasons I’ve been given over my career by potential or actual clients for making or wanting to make changes to their investments:

“Biden and the Democrats are going to run the country into the ground.” – Reason for moving to cash.

“Trump and the Republicans are going to ruin the country.” – Reason for moving to cash.

“My friend said to buy XYZ stock and he’s rich” – Reason for buying a stock

“My friend is in the ABC industry and he said we are headed for a recession” – Reason for selling and moving to cash.

“We still haven’t seen the bottom, we’ve got further to go before I get back in.” – Reason for staying in cash.

“The market is going to crash” – I have heard this every year since 2015.

I don’t want to minimize anyone’s fears or feelings. Our emotions and convictions should be weighed heavily when coming up with an allocation (mix of stock and bonds). They should not however drive decisions in the heat of the moment.

Dangers of Market Timing

Is it possible you could be right when you decide to go to cash or take on more risk? Yes, of course it is.

The trouble is, you have to be right twice. You have to know when it’s going to go in the direction you predicted AND you have to know when it’s going to move back in the other direction.

The likelihood of being right twice in a profitable manner is not very high in my opinion and experience.

So what happens when you’re wrong? Well, to put it simply, you lose money. Actual money or money you would’ve had if you hadn’t stayed in cash.

Dalbar Inc does an annual analysis of investor behavior they call their QAIB (qualitative analysis of investor behavior). This illuminates the dangers of trying to time the market.

For example, in their recent study, they compared the performance of the average equity fund investor and the S&P 500 over the last 30 years (1992-2021).

The average equity fund investor earned 7.13%, and the S&P 500 earned 10.65%. So how much money did the average investor miss out on?

If both started with $100,000 and did not invest anything else, the average investor would have $789,465 after 30 years invested. The $100,000 in the S&P 500 would have grown to $2,082,296 over that same period.

That’s a difference of $1,292,831.

It goes without saying, but we always have to say it, past performance doesn’t guarantee future results. I do believe the market is pretty efficient though and it’s tough to beat consistently.

Time in the Market

Time in the market is pretty self-explanatory, but it’s not always the easiest thing to do.

When things start to get choppy or volatile, our natural reaction is to do something. That’s okay. Our brains are fascinating and fight or flight has protected us for a long time.

Thankfully we’ve come a long way and while that part of our brain is still useful, it’s not as needed when it comes to most of our daily lives now. That is especially true when it comes to investing.

The premise behind “time in the market” is that by not making any rash decisions and letting your money ride the natural ups and downs of the market, you will do better long term.

The above is with the assumption that you have a long-term strategy and an investment policy statement (IPS) either between you and your planner/advisor or for yourself if you self-manage to guide your decisions.

Where’s the Proof?

There have been many studies done on market performance. These studies are vast and vary in their focal points.

One that I find very interesting and sheds some light on the market timing vs. time in the market discussion is the performance of a portfolio based on missing the best and worst days over a particular time period.

It’s pretty amazing to see what missing just a few days over twenty years can do to your returns.

One study showed the S&P 500 returns over the past 3 years (as of Feb 2022). If you stayed in the market the whole time, your 3-year average return would’ve been 17.1%.

If you missed just the 10 best trading days over that same period, your average return would’ve been -2.38%. Miss the best 20 days and your return would’ve been -10.97%.

If you had $100,000 invested and stayed invested, you’d have $160,572 at the end of the 3 years.

If you missed the best 10 days, you’d have $93,028 after 3 years.

Lastly, if you missed the best 20 days, you’d have $70,568.

While this isn’t a perfect study (nor is the Dalbar study), both show that staying invested, even when it’s hard, is beneficial in the long run.

In Conclusion

Nobody can prevent you from making decisions on your investments. Only you have that power.

I feel strongly that trying to time the market is a form of gambling. It’s betting on something you have no control over nor is predictable.

So if you can’t realistically time the market, what should you do?

I would recommend the following:

Start with a financial plan. This should drive all of the financial decisions you make. Not just your investing decisions.

Have an investment policy statement (IPS) that guides your investment decisions.

Be wary of where you get the information that leads you to making decisions.

Don’t make any rash decisions that are emotionally driven (easier said than done).

Put some guardrails in place to prevent potential emotional decisions (as I said above, easier said than done).

Lastly, I would recommend you find someone who understands what those investments are for (this is typically a “who” not a “what”) and who will (with your permission) hold you accountable to what you’ve shared is most important and always point you back to that.

Did You Know?

The 10 best trading days of the last 20 years all happened in March/April of 2020 or during a 5-month period from the end of 2008 to early 2009.

All of them happened during a time when most investors would be fleeing to “safety” if they were trying to time the market.

Quotable

Ask yourself this question: ‘Will this matter a year from now?’

–Richard Carlson

Connect with Us:

If you like what you’ve read and would like to get more helpful advice in the future, click this link to subscribe to our newsletter.