How are Your Investments Taxed?

Ever wonder what role taxes play in your investing? Do you know how the accounts you’re investing in are taxed?

You’ve probably heard the terms “pre-tax” and “tax-free” used at some point in your life. You’ve probably also heard the terms 401(k), IRA, and Roth IRA.

Do you know what they mean?

Many of you reading this will feel pretty confident, while others will have no clue.

That’s the thing about the financial world though. There are so many terms and acronyms that it’s hard to know it all or even most of them.

My goal in writing this is to share the three most common ways people save/invest their money and how it is taxed. I’ll also share some pros and cons of each.

Pre-Tax: Traditional 401(k) or IRA

The term pre-tax means that the money you save will be invested, as it says, pre-tax. That amount will be deducted from your taxable income dollar for dollar.

You will not have to pay any taxes on what you’ve invested until you start taking distributions in the future.

Example: If you make $100,000 and you save $10,000 pre-tax into your 401(k), you will reduce your taxable income by $10,000. It will be as if you made $90,000 in the eyes of the IRS.

If you do this for 30 years and get a return of 6%, you will have over $830,000 (compound interest is pretty awesome) in your 401(k). You will not have paid any tax on the gain over that 30-year period.

You will have to pay ordinary income tax on every dollar you take out.

Pros:

Reduce current income dollar for dollar.

Pay no taxes on dividends, interest, or capital gains while the money is invested.

Typically offered with employer match for 401(k)s.

Cons:

Pay ordinary income rates on distributions for retirement.

10% penalty if you need to take money out before age 59.5 (with some exceptions).

There are limits on how much you can contribute.

Pre-tax 401(k) for 2022 – $20,500 if you’re under 50. $27,000 if you’re older.

Pre-tax IRA for 2022 – $6,000 if you’re under 50. $7,000 if you’re older.

There are limitations on who can contribute based on your income and whether or not you have access to a workplace retirement plan.

Things to consider:

What is your current marginal tax rate (tax rate on the next dollar earned)?

Does your employer offer a 401(k)?

If so, is there a match?

If you’re close to retirement, what do you expect your expenses to be?

Do you have other sources of income when you retire? How will they be taxed?

Will you need to spend the money from this account in retirement?

If not, how will this impact your beneficiary’s tax situation in the future?

Post-tax: Roth 401(k) or IRA

The money saved in a post-tax account is the opposite of pre-tax. You get no current year deduction for money saved. After that though, you will never pay taxes on the money in that account again.

Example: If you make $100,000 and you save $10,000 post-tax into your Roth 401(k), you will still be taxed on the full $100,000 of income.

Like the previous example, if you do this for 30 years and get an average annual return of 6%, you will have over $830,000 in your Roth 401(k). You still will not have paid any tax on the gain over that 30-year period.

Any money that you pull out in the future will be tax-free.

Pros:

The money you take in retirement will be tax-free.

Pay no taxes on dividends, interest, or capital gains while the money is invested.

Sometimes offered as an option with employer 401(k)s.

Cons:

No deduction for contributions.

10% penalty if you need to take money out before age 59.5 (with some exceptions).

There are limits on how much you can contribute.

Roth 401(k) for 2022 – $20,500 if you’re under 50. $27,000 if you’re older.

Roth IRA for 2022 – $6,000 if you’re under 50. $7,000 if you’re older.

There are limitations on who can contribute based on your income.

Things to consider:

What is your current marginal tax rate (tax rate on the next dollar earned)?

Can you contribute directly to a Roth IRA (income based)?

If you’re close to retirement, what do you expect your expenses to be?

Do you have other sources of income when you retire? How will they be taxed?

Will you need to spend the money from this account in retirement?

If not, how will this impact your beneficiary’s tax situation in the future?

Taxable: Individual or Jointly Held

The money saved into a taxable account goes in post-tax. In other words, you receive no deduction. While the money is invested, you will pay tax on any interest, dividends, or capital gains you receive.

Lastly, when you pull the money out, you will have to pay taxes again depending on how long you’ve held the investment.

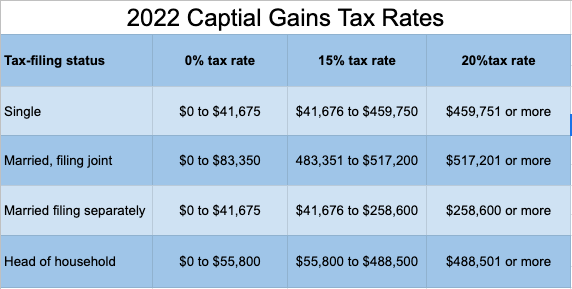

If you’ve held the investment for more than 1 year, you will pay long-term capital gains rates. See below.

If you’ve held the investment for less than a year, it will be considered a short-term capital gain and taxed as ordinary income.

Pros:

Liquidity. There are no penalties for taking money out of your taxable account before age 59.5.

You can usually have the funds you need in as little as two days (the amount of time it typically takes for a trade to clear and cash to be available).

No limits on contributions

You can save as much as you want into a taxable account. This is a great place to save a lot of money.

Only taxed on the gain and some of that gain can be tax-free (see “Did You Know” below).

When a taxable account is passed on to your children they get a step-up in basis.

This means any gain in the account will not have any tax owed on it and the new basis will be reset to the value at the date of death (or alternative date of death).

Cons:

Often the least tax-efficient place to save of the three options.

No deductions or tax deferrals from the government.

Can add unwanted additional income during pre-retirement years.

This is especially true if mismanaged or a lot of the money is invested in active funds or traded frequently.

Things to consider:

Have you maxed out your pre and post-tax accounts?

How long are you planning on the money being invested?

Do you have any short to mid-term need for the money being invested?

Will you be passing some of this money on to your heirs?

Did You Know?

There is a 0% long-term capital gains rate? In 2022, a married person filing jointly will pay no tax on their LT capital gains if their income is below $83,350. That number is $41,675 for a single filer.

Quotable

“Many people take no care of their money till they come nearly to the end of it, and others do just the same with their time.”

— Johann Wolfgang von Goethe

Connect with Us:

If you like what you’ve read and would like to get more helpful advice in the future, click this link to subscribe to our newsletter.