April, 2023 / Lee Hyde, CFP®

tax refundsWe are past the April filing deadline so at this point you’ve hopefully done one of two things.

Filed and received a refund or figured out how much you owe (if any).

Filed for an extension.

In our newsletter for this quarter, we’re going to focus on those of you who have already filed and are getting or already received a refund.

I Got a Refund!

There’s an interesting psychological phenomenon that happens during tax season.

There is a level of excitement that’s seemingly unanimous when it comes to getting a refund from the IRS. It’s so interesting to me at this point in my life knowing what I know, but I was once part of said phenomenon.

First, I think it’s important to understand what a refund is and then clarify what a tax refund is.

Refund: to return (money) in restitution, repayment, or balancing of accounts.

Return in restitution (a restoration of something to its rightful owner). Repayment. Balancing of accounts.

To get a refund, you’re getting something back that already belongs to you.

Tax Refund: a reimbursement to taxpayers who have overpaid their taxes.

When you get a tax refund, you’re getting back money that is already yours and has been for the past 12 months.

I know many people who are excited to get their refund and use it to do fun things or practical things.

I don’t want to make anyone feel shame about being happy for getting money back. In fact, I know many people do good things with their refunds. Things like paying off some debt, taking a family trip, or building up their emergency fund.

None of those things are bad and tax refunds aren’t inherently bad. I merely want to make sure everyone understands what they’re actually getting.

I think in the interest rate environment that we’re currently in, it’s even more important.

Interest-Free Loan

I bet if I polled every person in America and asked them if they would loan the US government a few thousand dollars for the next year at 0% interest, not one single person would say yes (if they were being honest).

Would you? Be honest.

You might do that for a family member or a close friend, but the government or a big company that has way more money than you or I could ever imagine? No way.

If we were going to loan the government money or a big corporation or even a super-wealthy person, we’d fully expect to get some interest paid on the money we lent.

That’s the thing though, a tax refund is exactly that, an interest-free loan. When you get your $5,000 back from the government, you’ve essentially let them borrow your money at no interest for the past year.

Currently, there are money market accounts with 7-day yields in the mid to upper 4’s and online savings accounts currently in the mid to high 3’s. If you’d invested in one of these, you could’ve earned $175-$240 on that $5,000 over the past year.

Better yet, you could have used the $416/month ($5,000/12) to pay off that credit card debt you have with a 24% interest rate. Or the student loan or car note at 6-10%.

Or you could’ve saved $416/month into your kid’s 529 account for their college education.

Or you could’ve saved $416/month more into your 401(k). This actually would’ve reduced your taxable income even more.

Let’s say instead of getting a refund, you did the above for the next 30 years.

What kind of impact could that have?

If you saved an additional $416/month into your 401(k) or any long-term investment account really, you’d have close an additional $400,000 in your account. (This assumes a 6% average rate of return).

All you have to do is give up your tax refund and reallocate the money that’s already yours toward something meaningful.

Why is it So Hard?

When you look at the math, it makes all the sense in the world to keep the money that’s already yours and use it wisely towards one of your goals.

If it’s that simple, why don’t more people do it?

There are a few reasons in my opinion.

The first is that as far as I can remember, getting a tax refund has always been seen (by the masses) as a good thing.

I’ve heard things like it’s “free money” which is ironic because that’s exactly what it was just not in the way they are describing it.

I do get the sentiment though. It was money that was not currently in their possession, therefore, it’s extra money they did not have. Psychologically that feels good.

The second reason is I don’t think many people understand why they get a refund and/or what to do about it.

Many of the folks we work with are self-employed, run a small business, or have some sort of side hustle where their income isn’t easily predictable. Most in this category don’t end up getting a tax refund so our tax planning is a little different.

The majority of people who get refunds are W-2 employees. Their income is pretty predictable. Many times, their withholdings directly impact whether or not or how much of a refund they will get every year.

If you receive a refund every year and you’d like to put that money to work instead of loaning it to the government, take a look at your withholdings. Ask your CPA or visit the IRS website to figure out what you can do to get closer to breaking even every year.

Once you’ve made these adjustments, look at the difference it makes in your next paycheck. Then put that money to work for you and your goals.

Lastly, and this is my opinion, most people aren’t using their money wisely already so having a couple of hundred dollars a month extra would just end up being spent frivolously or wasted anyways.

I again get this sentiment. It’s pretty easy to waste a few hundred dollars each month. But when you get a check or deposit for a few thousand dollars, that at least makes you think about what you’re going to do with the money.

What Now?

I think the best place to start is by looking back over the past several years to see if there is any consistency to your tax situation.

From there, if you’re consistently getting a refund, I think the next step is asking yourself some questions. And answer them honestly.

What are you currently doing with your tax refund?

What could you do if you got that money over 12 months instead of a lump sum?

If you make changes to your withholdings that lead to an increase in your monthly take home pay, will you actually put that additional money to good use?

The answers to these questions will help you to know wether or not you should consider making changes.

The answers may lead you to discover your need some help with implementation or accountability. If so, go interview some good financial planners and hire someone who will help you with this and more.

Monthly Minute

Be on the lookout this quarter for more helpful planning information in our upcoming Monthly Minute releases.

GET TO KNOW OUR TEAM

This past quarter we launched into 2023. Lee and Susanne celebrated their 13th wedding anniversary by taking their family to Atlantis in the Bahamas! This involved lots of fun in the sun, good food, and some really cool encounters with sea turtles!

Happy Birthday!

Lee got to celebrate his birthday with his grandma (Memaw) in February.

Their birthdays are 3 days apart. Getting to celebrate with her every year is very special to Lee!

Softball and Baseball Season!

Charlotte and Noah each moved up an age group this Spring. Both are doing great and so are their teams. Lee is enjoying the opportunity to coach both of them and their friends!

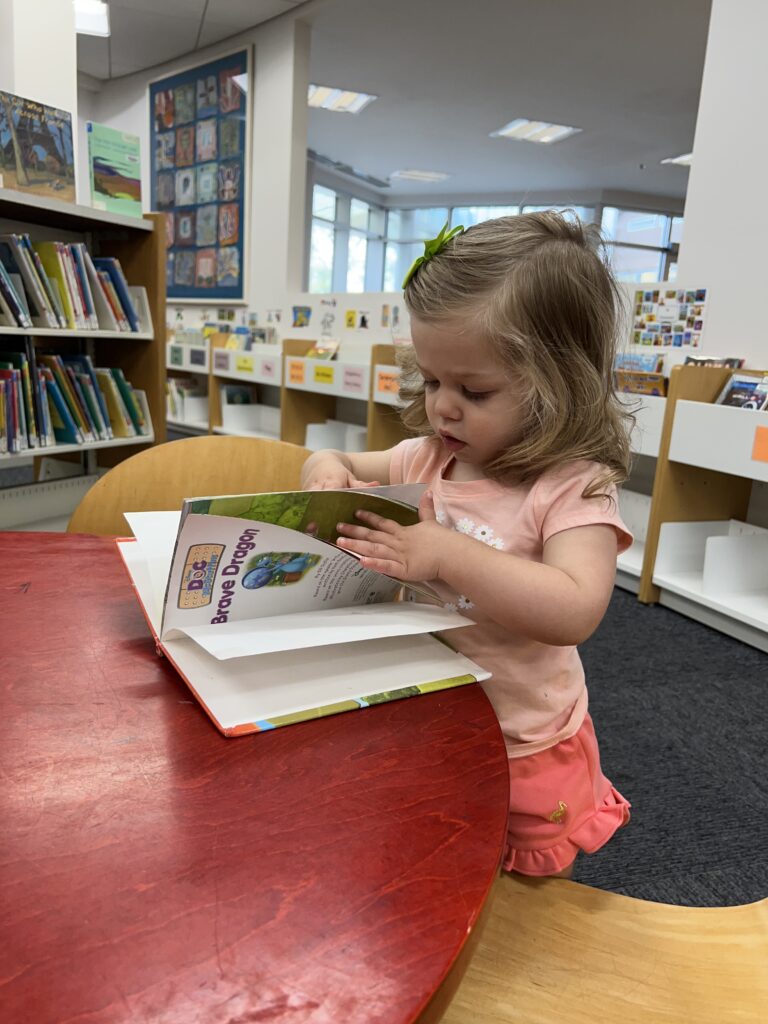

A First For Blair!

The Ray family had a fun-filled first quarter of the year as well! Blair got to take her first trip to the library and even get her own library card!

Release the Kraken!

Kyle took a trip to New York to meet up with some friends from around the country. They enjoyed some shows and great dining, but the highlight (and purpose of the trip) was catching a Kraken hockey game. Since Atlanta no longer has a hockey team and Kyle has several friends in Seattle, he’s adopted the Kraken as his team.

Muddy Puddles!

All the rain we have been having might not be fun for us grownups, but for toddlers, it makes for a great time.

Blair got her first experience of playing in muddy puddles, and as you can see, she loved it!

HOW TO STAY CONNECTED

If you like what you’ve read and would like to get more helpful advice in the future, click the link below to subscribe to our newsletter.

If what you read today has stirred up some questions and you’d like to discuss further. Click here to schedule a free introductory call with our team.

You can also check us out on our Facebook, Twitter, or LinkedIn.